Retirement Calculator - Plan Your Financial Future Today

Planning for retirement is one of the most important financial decisions you will ever make. Our free retirement calculator helps you estimate how much money you need to save for a comfortable retirement. Whether you are just starting your career or approaching your golden years, understanding your retirement savings goal is essential for financial security.

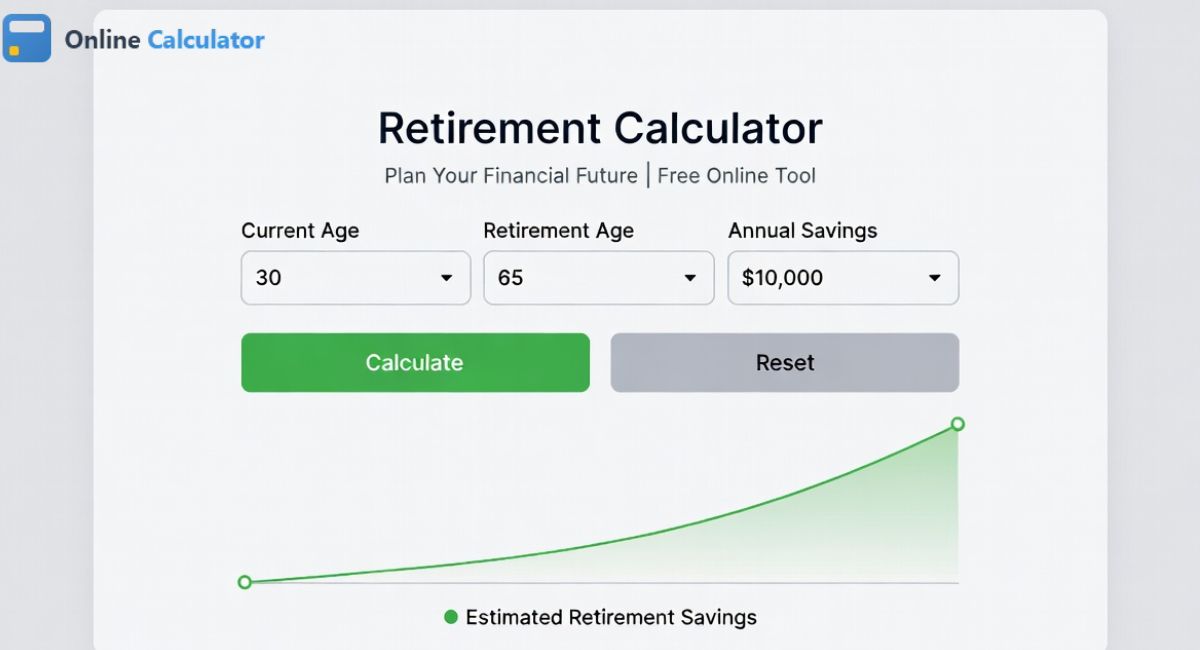

This comprehensive retirement planning tool takes into account your current age, desired retirement age, current savings, monthly contributions, expected rate of return, and anticipated retirement expenses. By using this calculator, you can make informed decisions about your retirement savings strategy and adjust your financial plan accordingly.

Retirement Savings Calculator

Your Retirement Projection

How to Use This Retirement Calculator

Using our retirement savings calculator is simple and straightforward. Follow these steps to get an accurate estimate of your retirement readiness:

- Enter Your Current Age: Input your present age in years. This helps determine how many years you have left to save for retirement.

- Set Your Retirement Age: Choose the age at which you plan to retire. Most people retire between 60 and 67 years old, but you can customize this based on your goals.

- Input Current Savings: Enter the total amount you have already saved for retirement, including 401(k), IRA, pension funds, and other retirement accounts.

- Specify Monthly Contribution: Enter how much you plan to contribute to your retirement savings each month.

- Set Expected Return Rate: Enter the anticipated annual rate of return on your investments. A conservative estimate is typically between 5% and 7%.

- Estimate Monthly Expenses: Input your expected monthly living expenses during retirement, including housing, healthcare, food, and leisure activities.

- Enter Retirement Duration: Estimate how many years you expect to live in retirement. Consider your family history and health when making this estimate.

- Click Calculate: Press the calculate button to see your retirement projection instantly.

Understanding the Retirement Calculation Formula

Our retirement calculator uses the future value formula combined with present value calculations to determine your retirement readiness. Understanding these formulas helps you appreciate how compound interest works in your favor over time.

FV = PV × (1 + r)^n + PMT × [((1 + r)^n - 1) / r]

Where:

FV = Future Value (projected savings at retirement)

PV = Present Value (current savings)

r = Monthly interest rate (annual rate / 12)

n = Number of months until retirement

PMT = Monthly contribution

The calculator also determines the total amount needed for retirement by multiplying your expected monthly expenses by the number of months in your retirement duration. This gives you a clear picture of whether your projected savings will meet your retirement income needs.

Benefits of Using a Retirement Calculator

Planning your retirement with a dedicated calculator offers numerous advantages for your long-term financial health:

Financial Clarity and Goal Setting

A retirement calculator provides clear visibility into your financial future. By seeing concrete numbers, you can set realistic savings goals and track your progress over time. This clarity helps eliminate the uncertainty that often surrounds retirement planning.

Early Detection of Savings Gaps

One of the most valuable benefits is identifying potential shortfalls early. If your projected savings fall short of your retirement needs, you have time to adjust your strategy by increasing contributions, delaying retirement, or reducing expected expenses.

Informed Investment Decisions

Understanding how different return rates affect your retirement savings helps you make better investment choices. You can experiment with various scenarios to see how aggressive or conservative investment strategies impact your retirement fund.

Motivation to Save More

Seeing the power of compound interest in action can be incredibly motivating. When you realize how small increases in monthly contributions can significantly boost your retirement savings, you may be inspired to save more consistently.

Stress Reduction

Financial uncertainty is a major source of stress for many people. Having a clear retirement plan based on calculated projections can provide peace of mind and reduce anxiety about your financial future.

For other financial calculations, you might also find our GST Calculator helpful for tax-related computations.

Factors That Affect Your Retirement Savings

Several key factors influence how much you need to save for retirement and how quickly your savings will grow:

Inflation Rate

Inflation erodes the purchasing power of your money over time. What costs $1,000 today may cost significantly more in 20 or 30 years. A good retirement plan accounts for inflation by assuming your expenses will increase over time.

Social Security Benefits

Government retirement benefits can supplement your personal savings. However, relying solely on social security is not recommended. Consider these benefits as a bonus rather than your primary retirement income source.

Healthcare Costs

Medical expenses typically increase as you age. Healthcare costs are one of the largest expenses retirees face, so it is important to factor in health insurance premiums, medications, and potential long-term care needs.

Lifestyle Choices

Your desired retirement lifestyle significantly impacts how much you need to save. Traveling frequently, maintaining multiple properties, or pursuing expensive hobbies requires more savings than a modest retirement lifestyle.

Limitations of Retirement Calculators

While retirement calculators are valuable planning tools, they have certain limitations you should be aware of:

- Assumptions May Vary: Calculators use assumptions about return rates and inflation that may not match actual market performance.

- Cannot Predict Market Volatility: Investment returns fluctuate year to year, and calculators typically use average returns rather than accounting for market ups and downs.

- Life Changes: Unexpected events like job loss, health issues, or family changes can significantly alter your retirement plans.

- Tax Implications: Most basic calculators do not account for taxes on retirement withdrawals, which can substantially affect your actual retirement income.

- Simplified Calculations: Real retirement planning involves many complex factors that simple calculators cannot fully address.

For more comprehensive retirement planning tools and resources, you can explore additional calculators at Calculator.net.

Tips for Maximizing Your Retirement Savings

Here are proven strategies to help you build a larger retirement nest egg:

- Start Early: The earlier you begin saving, the more time compound interest has to work in your favor. Even small contributions in your twenties can grow substantially by retirement.

- Maximize Employer Matching: If your employer offers 401(k) matching, contribute at least enough to get the full match. This is essentially free money for your retirement.

- Increase Contributions Gradually: Commit to increasing your retirement contributions by 1% each year or whenever you receive a raise.

- Diversify Investments: Spread your retirement savings across different asset classes to reduce risk and potentially improve returns.

- Minimize Fees: High investment fees can significantly reduce your retirement savings over time. Choose low-cost index funds when possible.

- Avoid Early Withdrawals: Taking money from retirement accounts before age 59½ typically results in penalties and taxes, plus you lose future growth potential.

- Consider Catch-Up Contributions: If you are 50 or older, take advantage of catch-up contribution limits to boost your savings in the years before retirement.

Frequently Asked Questions About Retirement Planning

How much money do I need to retire comfortably?

The amount needed for a comfortable retirement varies based on your lifestyle, location, and health. A common guideline suggests having 10 to 12 times your annual salary saved by retirement age. However, using a retirement calculator with your specific expenses provides a more accurate estimate.

What is the 4% rule in retirement planning?

The 4% rule suggests that retirees can withdraw 4% of their retirement savings in the first year of retirement, then adjust that amount for inflation each subsequent year. This strategy aims to make your savings last approximately 30 years.

At what age should I start saving for retirement?

The best time to start saving for retirement is as early as possible, ideally in your twenties when you begin your career. However, it is never too late to start. Even beginning in your forties or fifties can make a significant difference in your retirement security.

How does compound interest affect retirement savings?

Compound interest allows your money to grow exponentially over time because you earn returns not only on your original contributions but also on previously earned interest. This snowball effect makes early and consistent saving extremely powerful for building retirement wealth.

Should I pay off debt or save for retirement first?

Generally, you should prioritize high-interest debt like credit cards while still contributing enough to retirement accounts to get any employer match. Once high-interest debt is paid off, you can increase retirement contributions. Low-interest debt like mortgages can often be managed alongside retirement savings.

What is the difference between a 401(k) and an IRA?

A 401(k) is an employer-sponsored retirement plan with higher contribution limits and potential employer matching. An IRA (Individual Retirement Account) is opened independently and offers more investment choices but has lower contribution limits. Many people use both to maximize their retirement savings.

How accurate are retirement calculators?

Retirement calculators provide useful estimates based on the information you provide and certain assumptions about investment returns and inflation. While they cannot predict the future with certainty, they offer valuable guidance for retirement planning and help identify potential savings gaps.

Conclusion

A retirement calculator is an essential tool for anyone serious about securing their financial future. By understanding your retirement savings needs, projected growth, and potential gaps, you can make informed decisions that lead to a comfortable and stress-free retirement. Start planning today, review your progress regularly, and adjust your strategy as needed to stay on track toward your retirement goals. Remember, the best time to start planning for retirement was yesterday, but the second best time is right now.