🧮 GST Calculator

Free Online GST Calculator - CGST, SGST, IGST Calculation

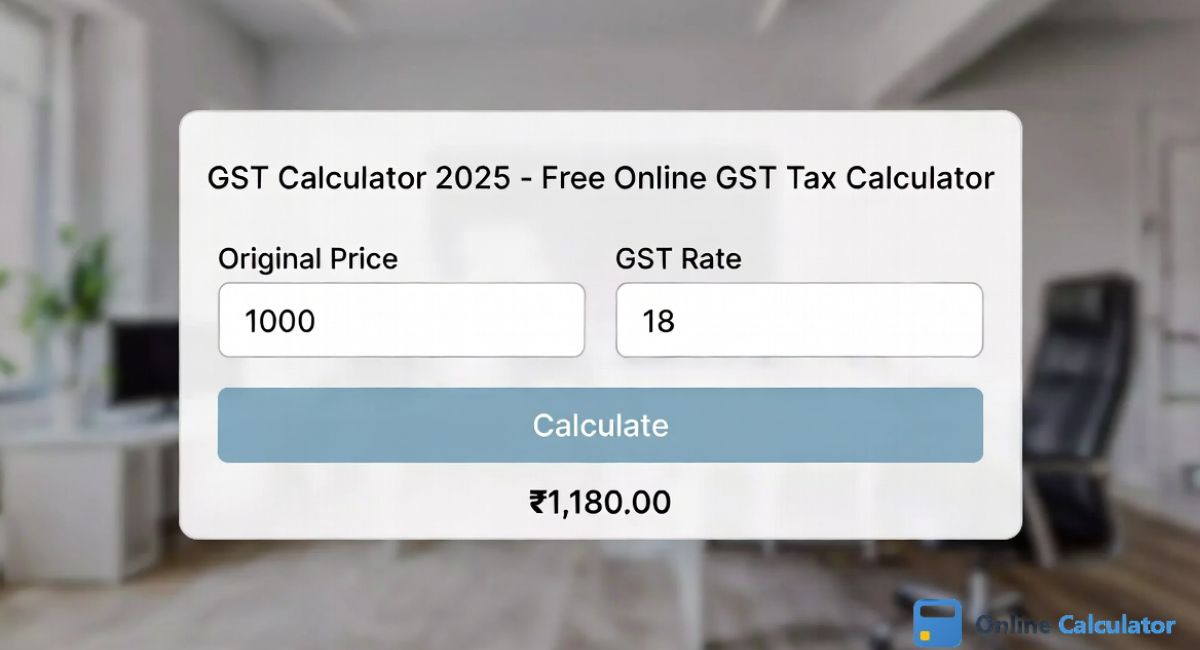

Calculate Your GST Amount

What is a GST Calculator?

A GST Calculator is an online tool that helps you easily calculate the Goods and Services Tax (GST) on any product or service. Our free GST calculator is the most accurate and user-friendly tool available.

GST Full Form and Introduction

GST stands for "Goods and Services Tax". It is a comprehensive indirect tax that was introduced on July 1, 2017. GST replaced multiple taxes like VAT, Service Tax, and Excise Duty with a single unified tax system.

GST Rates Explained

There are 4 main GST tax slabs. Different products and services have different rates applied to them:

| GST Rate | Items/Services |

|---|---|

| 0% GST | Fresh vegetables, fruits, milk, eggs, bread, salt, books |

| 5% GST | Sugar, tea, coffee, edible oil, coal, medicines, economy class flight tickets |

| 12% GST | Butter, cheese, ghee, mobile phones, computers, processed food |

| 18% GST | Hair oil, toothpaste, soap, capital goods, industrial machinery, IT services |

| 28% GST | Luxury cars, pan masala, tobacco, aerated drinks, AC, washing machine |

Types of GST

There are three types of GST:

1. CGST (Central GST)

CGST is collected by the Central Government. When a transaction happens within the same state, half of the total GST goes as CGST.

2. SGST (State GST)

SGST goes to the State Government. In intra-state transactions, SGST is charged in equal amount along with CGST.

3. IGST (Integrated GST)

IGST applies to inter-state transactions. When goods or services move from one state to another, IGST is applied.

How to Calculate GST? (GST Calculation Formula)

There are two ways to calculate GST:

Method 1: Adding GST (Exclusive)

When you need to add GST to the original price:

Final Price = Original Price + GST Amount

Example: $1000 item with 18% GST

GST = (1000 × 18) / 100 = $180

Final Price = 1000 + 180 = $1180

Method 2: Removing GST (Inclusive)

When GST is already included in the price:

GST Amount = Total Price - Original Price

Example: $1180 with 18% GST included

Original = 1180 × (100/118) = $1000

GST Amount = 1180 - 1000 = $180

Benefits of GST

- One Nation One Tax: A uniform tax system across the entire country

- Reduced Tax Burden: Eliminates cascading effect (tax on tax)

- Easy Compliance: Online filing and simplified process

- Transparency: Clear tax structure and accountability

- Boost to Economy: Easier interstate trade

For official information about GST, visit the GST Portal (gst.gov.in). You can also use Zoho GST Calculator for more GST tools.

When is GST Registration Required?

GST Registration is mandatory in the following cases:

- Annual turnover more than $50,000 (for goods)

- Annual turnover more than $25,000 (for services)

- Businesses doing inter-state supply

- E-commerce operators and sellers

- Casual taxable persons

Frequently Asked Questions (FAQs)

Enter the amount in our GST Calculator, select the GST rate (5%, 12%, 18%, or 28%), then choose whether to add or remove GST. Click the Calculate button and see the result instantly.

CGST (Central GST) goes to the Central Government and SGST (State GST) goes to the State Government. Both are charged in equal amounts. For example, in 18% GST, there is 9% CGST + 9% SGST.

GST Exclusive: GST is not included in the price and will be added separately.

GST Inclusive: GST is already included in the price.

Yes, this GST Calculator is 100% free. You can do unlimited calculations without any registration or payment.

Regular taxpayers need to file monthly or quarterly GST returns. GSTR-1 (outward supplies) is due by the 11th of each month and GSTR-3B is due by the 20th of each month.