Interest Calculator - Calculate Simple & Compound Interest Online

Welcome to our free Interest Calculator, a powerful financial tool designed to help you compute interest on your savings, investments, and loans. Whether you need to calculate simple interest or compound interest, this calculator provides accurate results in seconds. Understanding how interest works is essential for making smart financial decisions, and our tool makes it easy for everyone.

Interest calculations play a crucial role in personal finance, banking, and investment planning. From determining how much your savings will grow over time to understanding the true cost of a loan, knowing how to calculate interest empowers you to take control of your money. This comprehensive guide will walk you through everything you need to know about interest calculation.

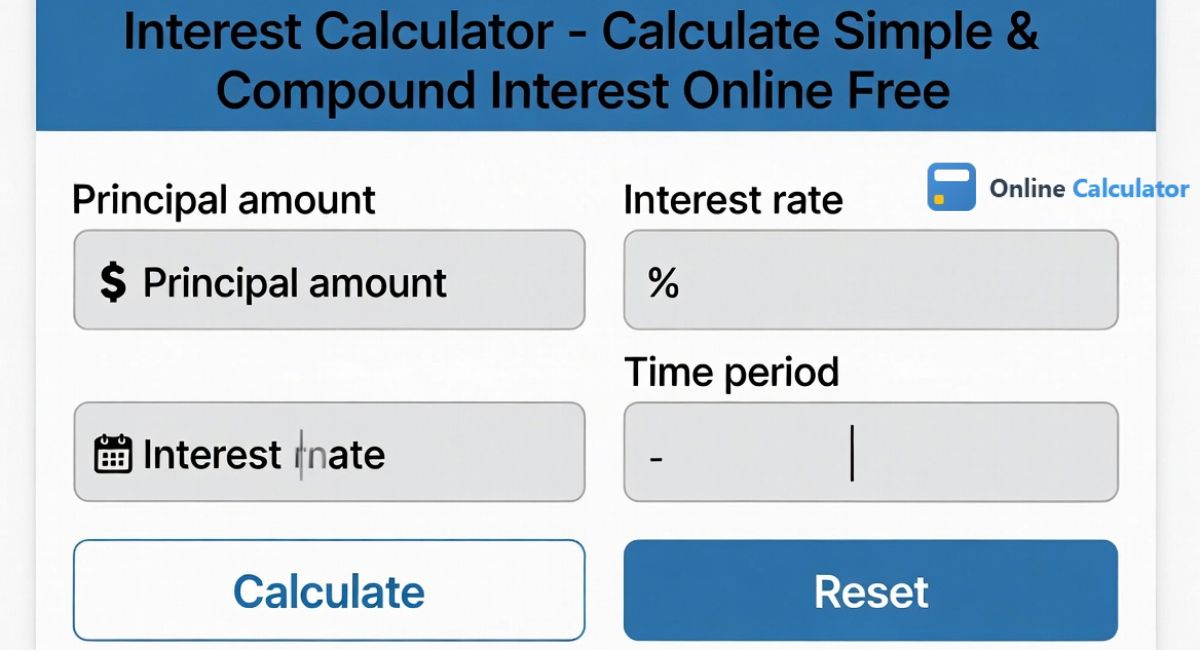

Calculate Your Interest

Calculation Results

How to Use This Interest Calculator

Using our interest calculator is straightforward and requires just a few simple steps:

Step 1: Enter your principal amount. This is the initial sum of money you are investing, saving, or borrowing. For example, if you deposit $10,000 in a savings account, that is your principal.

Step 2: Input the annual interest rate. This is the percentage rate at which your money will grow or the rate charged on a loan. Banks and financial institutions typically express this as an annual percentage rate (APR).

Step 3: Specify the time period in years. This represents how long your money will be invested or how long you will take to repay a loan.

Step 4: Select the interest type. Choose between simple interest and compound interest based on your needs. Simple interest is calculated only on the principal, while compound interest is calculated on both the principal and accumulated interest.

Step 5: If you selected compound interest, choose the compounding frequency. This determines how often interest is added to your principal - annually, semi-annually, quarterly, monthly, or daily.

Step 6: Click the "Calculate Interest" button to see your results instantly.

Understanding Interest: Simple vs Compound

Interest is the cost of borrowing money or the reward for saving and investing. There are two primary types of interest that you should understand:

Simple Interest Explained

Simple interest is calculated only on the original principal amount throughout the entire loan or investment period. It does not take into account any interest that has already been earned or charged. This type of interest is commonly used for short-term loans, car loans, and some personal loans.

The simple interest formula is:

Simple Interest = Principal × Rate × Time

Or expressed mathematically: SI = P × R × T

Where P is the principal amount, R is the annual interest rate (in decimal form), and T is the time period in years.

Compound Interest Explained

Compound interest is often called "interest on interest" because it is calculated on both the initial principal and the accumulated interest from previous periods. This makes your money grow faster over time, which is why compound interest is preferred for long-term investments and savings accounts.

The compound interest formula is:

A = P × (1 + r/n)^(n×t)

Where A is the final amount, P is the principal, r is the annual interest rate (decimal), n is the number of times interest compounds per year, and t is the time in years.

To find just the interest earned: Compound Interest = A - P

Interest Calculation Formulas

| Interest Type | Formula | Best Used For |

|---|---|---|

| Simple Interest | SI = P × R × T | Short-term loans, car loans |

| Compound Interest (Annual) | A = P × (1 + r)^t | Savings accounts, bonds |

| Compound Interest (General) | A = P × (1 + r/n)^(nt) | Investments, mortgages |

Benefits of Using an Interest Calculator

There are numerous advantages to using an online interest calculator for your financial planning:

Accurate Financial Planning: An interest calculator eliminates manual calculation errors and provides precise results. This accuracy is essential when planning for retirement, saving for a major purchase, or comparing loan options.

Time-Saving Tool: Instead of spending time with complex mathematical formulas, you can get instant results with just a few clicks. This efficiency allows you to compare multiple scenarios quickly.

Better Investment Decisions: By understanding how different interest rates and compounding frequencies affect your returns, you can make more informed investment choices. You can see exactly how your money will grow over time.

Loan Comparison: When shopping for loans, an interest calculator helps you compare the true cost of different loan offers. You can see how much total interest you will pay over the life of each loan.

Goal Setting: Whether you are saving for a house, education, or retirement, calculating interest helps you set realistic financial goals and understand how much you need to save to reach them.

Understanding the Power of Compounding: Seeing compound interest calculations in action demonstrates why starting to save early is so important. Even small amounts can grow significantly over time.

For more detailed loan calculations including monthly payments and amortization schedules, check out our comprehensive loan calculator tool.

Limitations of Interest Calculations

While interest calculators are valuable tools, it is important to understand their limitations:

Simplified Assumptions: Basic interest calculators assume a constant interest rate throughout the investment period. In reality, interest rates on savings accounts and variable-rate loans can change over time.

Does Not Account for Fees: The calculated interest does not include account fees, transaction costs, or other charges that may reduce your actual returns or increase your loan costs.

Tax Implications Not Included: Interest earned on investments is often taxable. The calculator shows gross interest without accounting for taxes, which will affect your net returns.

Inflation Not Considered: The purchasing power of your money changes over time due to inflation. A dollar today is worth more than a dollar in the future, which is not reflected in basic interest calculations.

No Additional Contributions: Simple interest calculators typically do not account for regular deposits or withdrawals, which are common in real-world savings scenarios.

Practical Examples of Interest Calculation

Example 1: Simple Interest on a Personal Loan

Suppose you borrow $5,000 at a simple interest rate of 8% per year for 3 years. Using the simple interest formula:

SI = $5,000 × 0.08 × 3 = $1,200

Total amount to repay = $5,000 + $1,200 = $6,200

Example 2: Compound Interest on Savings

If you invest $10,000 in a savings account with 5% annual interest compounded monthly for 5 years:

A = $10,000 × (1 + 0.05/12)^(12×5) = $12,833.59

Total interest earned = $12,833.59 - $10,000 = $2,833.59

For additional interest calculation methods and advanced features, you may also find this interest calculator resource helpful.

Frequently Asked Questions About Interest Calculation

What is the difference between simple interest and compound interest?

Simple interest is calculated only on the original principal amount, while compound interest is calculated on both the principal and any accumulated interest. Compound interest results in faster growth over time because you earn interest on your interest. For long-term investments, compound interest can significantly increase your returns compared to simple interest.

How does compounding frequency affect my returns?

The more frequently interest compounds, the more you earn. Daily compounding yields slightly more than monthly compounding, which yields more than annual compounding. However, the difference becomes more noticeable with larger principal amounts and longer time periods. For most savings accounts, the difference between monthly and daily compounding is minimal.

What is APR and how does it relate to interest rate?

APR stands for Annual Percentage Rate. It represents the yearly cost of borrowing money, including interest and certain fees. For loans, APR gives you a more complete picture of the total cost than the interest rate alone. For savings and investments, the equivalent term is APY (Annual Percentage Yield), which accounts for compounding.

Can I use this calculator for mortgage interest?

This calculator can give you a general idea of interest on a mortgage, but mortgage calculations are more complex. Mortgages typically involve amortization schedules where the proportion of interest to principal changes with each payment. For accurate mortgage calculations, a dedicated mortgage calculator is recommended.

How do I calculate interest for periods less than one year?

For periods less than one year, simply enter the time as a decimal. For example, 6 months would be 0.5 years, 3 months would be 0.25 years, and 1 month would be approximately 0.083 years. The calculator will compute the interest accordingly.

Why is compound interest called the eighth wonder of the world?

This phrase, often attributed to Albert Einstein, highlights the remarkable power of compound interest to grow wealth over time. Because you earn interest on previously earned interest, your money can grow exponentially rather than linearly. Starting to save early and letting compound interest work over decades can turn modest savings into substantial wealth.

What interest rate should I expect on savings accounts?

Savings account interest rates vary widely depending on the type of account, the financial institution, and current economic conditions. Traditional savings accounts at major banks often offer lower rates, while high-yield savings accounts and online banks typically offer more competitive rates. Always compare rates from multiple institutions before opening an account.

Conclusion

Understanding how interest works is fundamental to making sound financial decisions. Our interest calculator simplifies the process of computing both simple and compound interest, helping you plan your savings, evaluate investments, and understand loan costs. Whether you are a student learning about finance, a professional planning for retirement, or anyone looking to grow their wealth, mastering interest calculations is an essential skill. Use this tool regularly to track your financial progress and make informed decisions about your money.