Loan Calculator - Calculate Your EMI and Interest Rate

Are you planning to take a loan? Whether you need a home loan, personal loan, or car loan, it is essential to know your EMI amount and total payment before applying. Our free online loan calculator helps you calculate everything in just a few seconds.

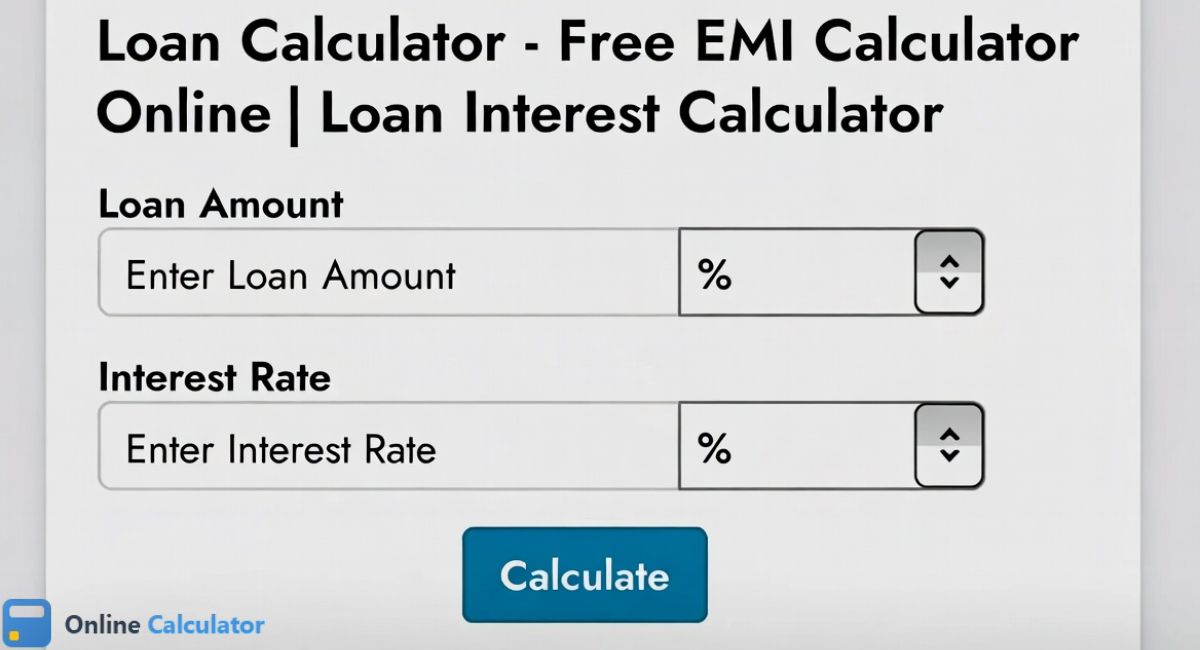

Loan Calculator

What is a Loan Calculator?

A loan calculator is an online tool that helps you calculate your EMI (Equated Monthly Installment) before taking a loan. It allows you to understand how much money you need to pay every month and how much total interest you will pay over the loan period.

EMI = [P x R x (1+R)^N] / [(1+R)^N - 1]

Where P = Principal Amount, R = Monthly Interest Rate, N = Number of Months

How to Use the Loan Calculator?

Using our loan calculator is very simple. Just follow these easy steps:

- Enter Loan Amount: Input the total loan amount you want to borrow (Example: $50,000)

- Enter Interest Rate: Input the annual interest rate offered by the bank (Example: 10.5%)

- Select Loan Tenure: Enter the number of years or months for repayment

- Click Calculate: Instantly see your EMI, total interest, and total payment

Types of Loans and Their Interest Rates

There are different types of loans available in the market. Each loan type has different interest rates:

| Loan Type | Interest Rate Range | Maximum Tenure |

|---|---|---|

| Home Loan | 6.5% - 10.5% | 30 Years |

| Personal Loan | 10.5% - 24% | 5 Years |

| Car Loan | 7.5% - 13% | 7 Years |

| Education Loan | 8% - 15% | 15 Years |

| Gold Loan | 7% - 17% | 3 Years |

Home Loan Calculator

Calculating your EMI before taking a home loan is very important because it is a long-term commitment. For example, if you take a $200,000 home loan for 20 years at 8.5% interest rate, your monthly EMI will be approximately $1,736 and you will pay around $216,640 as total interest.

For more detailed loan calculations, you can also use this Loan Calculator Tool.

Personal Loan Calculator

A personal loan is an unsecured loan that does not require any collateral. Because of this, the interest rate is usually higher than secured loans. Personal loans can be used for emergency expenses, weddings, travel, or medical bills.

If you are also interested in tracking your health, check out our BMI Calculator to monitor your body mass index.

Car Loan Calculator

A car loan is a great option for buying a new vehicle. In car loans, the car itself serves as collateral, which is why interest rates are lower than personal loans. You can get up to 90% financing on your car purchase.

Benefits of Using a Loan Calculator

- Budget Planning: Know in advance if you can afford the EMI

- Comparison: Compare interest rates from different banks

- Time Saving: No need to visit the bank, calculate from home

- Accurate Results: Get exact EMI using mathematical formula

- Free Tool: No charges or fees required

Tips to Reduce Your EMI

If your EMI seems too high, follow these tips to reduce it:

- Increase Down Payment: Higher down payment means lower loan amount

- Extend Tenure: Longer tenure reduces EMI (but increases total interest)

- Negotiate Interest Rate: Good credit score helps you get lower rates

- Make Prepayments: Pay extra whenever possible to reduce principal

- Balance Transfer: Transfer loan to a bank with lower interest rate

Things to Check Before Taking a Loan

- Processing fees charged by the bank

- Prepayment or foreclosure charges

- Hidden charges in the loan agreement

- Whether insurance is mandatory or optional

- EMI bounce charges and penalties

Frequently Asked Questions (FAQs)

Q: Does the loan calculator give accurate results?

Yes, the loan calculator uses the same mathematical formula that banks use. The results are 99% accurate. There might be slight differences due to processing fees and insurance costs.

Q: How to calculate EMI for floating rate loans?

In floating rate loans, the interest rate changes over time. You can calculate EMI using the current rate, but remember that your EMI may increase or decrease in the future.

Q: How much EMI can I afford?

Financial experts recommend that your total EMI (all loans combined) should not exceed 40% of your monthly income.

Q: Should I prepay my loan?

Yes, prepaying your loan whenever possible is a good idea. It reduces your total interest payment. However, check the prepayment charges before making any extra payments.

Q: Fixed vs Floating rate - which is better?

If you expect interest rates to rise, choose a fixed rate. If you expect rates to fall, a floating rate is better. For home loans, floating rates are more popular.

Conclusion

Taking a loan is a major financial decision. Our free loan calculator helps you calculate your EMI, total interest, and total payment before applying for a loan. This allows you to plan your finances better and choose the right loan according to your budget.

Remember - only take a loan when necessary and ensure you can comfortably afford the EMI. Maintain a good credit score to get lower interest rates. Always compare offers from multiple banks to get the best deal.

Also check out our BMI Calculator to track your health and fitness goals.